In a significant development that could potentially reshape the economic landscape, the Federal Reserve has made the pivotal decision to halt interest rate hikes, signaling the end of the current cycle of monetary tightening. This move has set the stage for the next phase of economic policy, which is anticipated to involve cuts to interest rates. The announcement, which came ahead of a much-awaited press conference, suggests a strategic pivot by the Fed in response to the evolving economic conditions.

The Fed’s Strategic Pivot and Its Implications

The Fed’s decision not to raise interest rates marks a crucial turning point, indicating a possible shift towards more accommodative monetary policy in the near future. According to the official projections and market expectations, the first rate cut could be on the horizon as soon as the next meeting on March 20th, with a 64% probability attached to this outcome. This aggressive forecast underscores the market’s anticipation of a swift response from the Fed to changing economic dynamics.

As we await further details from the Fed’s press conference, the overarching narrative is clear: the Fed is positioning itself to combat inflation more effectively while safeguarding economic growth. The notion of interest rate cuts, particularly in an environment where the last quarter’s GDP growth was a robust 3.3%, raises intriguing questions about the Fed’s assessment of the current economic health and the potential risks of maintaining higher interest rates.

The prospect of lower interest rates has far-reaching implications for various aspects of the economy and financial markets. From mortgages and business loans to credit cards and auto loans, the cost of borrowing is set to decrease, potentially stimulating economic activity across the board. This environment of ‘easy money’ could invigorate the markets and provide a much-needed boost to sectors that are sensitive to interest rate changes.

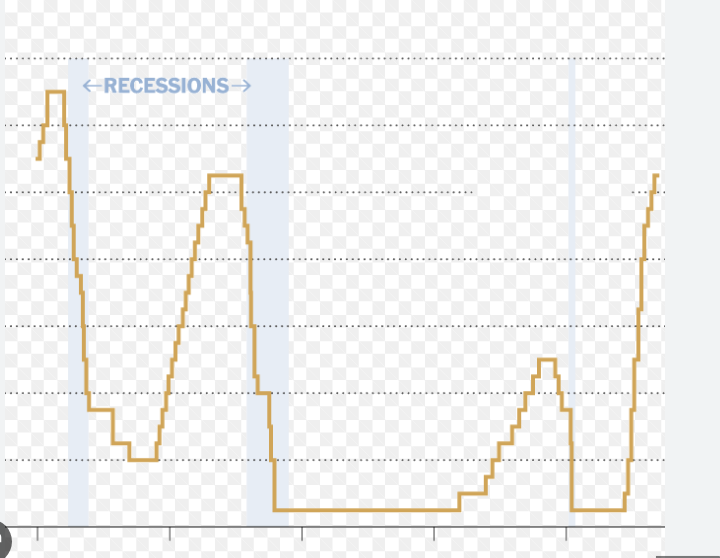

However, the rationale behind the Fed’s inclination towards rate cuts in a seemingly strong economic setting is a subject of much debate. The drop in the Fed’s preferred inflation measure, the PCE inflation, to 2.9%, is a critical factor in this decision-making process. The Fed appears to be preemptively addressing the risk of higher real interest rates slowing down the economy to the point of triggering a recession, as seen in historical precedents like 2001 and 2007.

The Labor Market and Economic Resilience

A pivotal concern for the Fed in its deliberation over interest rates is the state of the labor market. High interest rates can hamper business growth and employment, and any significant damage to the labor market could have long-lasting repercussions. The labor market’s health is notoriously difficult to gauge in real-time, and downturns can occur abruptly, underscoring the Fed’s cautious approach.

The Federal Reserve’s halt on interest rate hikes, coupled with the anticipation of future rate cuts, indicates a strategic shift aimed at sustaining economic momentum while keeping inflation in check. As the press conference unfolds and more details emerge, the financial community will be keenly analyzing the Fed’s insights and projections to gauge the trajectory of monetary policy and its implications for the economy.

Read More:

- Unveiling the Florida Documents Sparks Presidential Outcry

- CSU and faculty reach tentative agreement on first day of strike

- Multiple people injured in building collapse at Boise Airport | Full news conference

In summary, the Federal Reserve’s current stance heralds a potentially transformative period for the economy, with lower interest rates on the horizon. This policy adjustment is poised to influence a wide array of financial products and economic sectors, underlining the Fed’s proactive approach to navigating the complexities of the current economic landscape. As market participants and observers await further clarifications from the Fed, the broader implications of this policy shift for economic growth, inflation, and the labor market remain a focal point of discussion and analysis.