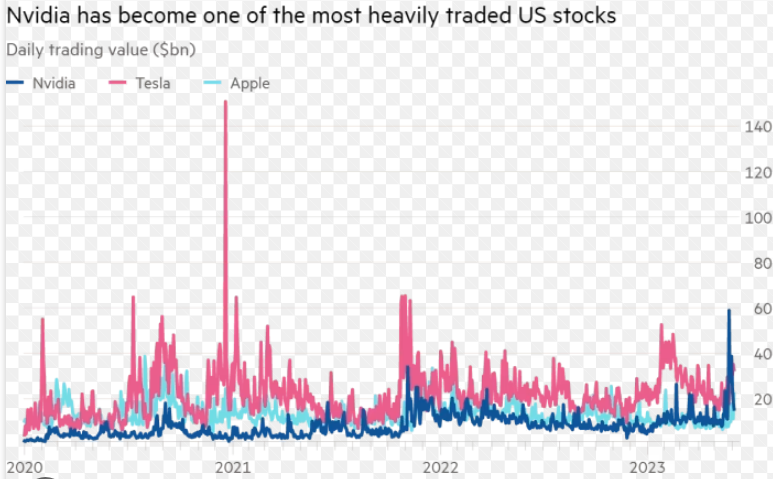

The chip giant Nvidia continues to impress investors, with its stock rallying by 40% this year alone. Today, the shares hit a record high, climbing approximately 3%. Analysts have expressed optimism leading up to the chipmaker’s earnings announcement later this month, propelling the stock even further after a remarkable surge of nearly 240% in 2023. This bullish sentiment towards Nvidia mirrors the broader optimism surrounding the semiconductor industry, as highlighted by the Semiconductor Industry Association’s positive Market Outlook. Despite a slow start, the industry experienced a significant rebound towards the end of last year, with double-digit growth forecasted for 2024.

Insights from Stacy Rasen Bernstein on Chip Industry Dynamics

In a discussion with Stacy Rasen Bernstein, managing director and senior analyst covering chips, she sheds light on various aspects of the chip industry and Nvidia’s position within it. Bernstein acknowledges the widespread optimism surrounding Nvidia’s future performance, attributing it partly to the company’s strong presence in the AI space. As AI adoption continues to grow, Nvidia stands out as a key player generating substantial revenue in this sector. Bernstein suggests that Nvidia’s earnings projections are likely to increase, given its dominance in AI and the relative affordability of its stock compared to other AI-focused companies.

Bernstein also comments on the increased capital expenditure (capex) plans announced by major cloud giants like Amazon, Microsoft, and Alphabet. She notes that heightened capex spending, particularly in the AI domain, bodes well for chip investors. However, Bernstein cautions that while AI-related investments are on the rise, certain segments of the semiconductor industry may not benefit equally. Notably, traditional data center components and industrial/auto sectors face varying degrees of weakness, impacting their revenue growth potential.

Regarding Intel’s recent announcement regarding delays in its expansion plans, Bernstein provides insights into the potential implications. She suggests that the delays are not primarily due to technical issues but rather a reflection of current market dynamics. With shifting revenue trajectories and evolving demand patterns, Intel’s capacity expansion may not align with immediate market needs. However, Bernstein emphasizes the importance of talent management in the semiconductor industry, particularly as companies ramp up production capacity.

Impact of Export Controls on US-China Relations

Bernstein delves into the complex dynamics between the US and China in the semiconductor space, especially concerning export controls. She explains how export restrictions affect companies like Nvidia, limiting their ability to sell AI-related components in China. Despite efforts to develop local alternatives, Bernstein highlights the widening performance gap between US and Chinese semiconductor offerings. While China aims to bolster its domestic chip industry, Bernstein suggests that long-term implications may include a diminished Total Addressable Market (TAM) for US companies.

In discussing China’s AI development, Bernstein emphasizes the need for creativity and innovation amidst regulatory constraints. She notes the significant investments in semiconductor infrastructure in China and the challenges posed by export controls. Despite facing obstacles, Chinese chip developers are striving to bridge the performance gap with their US counterparts. However, Bernstein underscores the complexity of the US-China semiconductor relationship and its broader implications for global tech dynamics.

Read More:

- Legal Limbo: Judge Chutkan delaying interference trial may not be boon for Trump

- Wall Street Week Votes: What the Economy Needs in the Next Four Years

- How to Dance in Ohio’ makes Broadway history

Stacy Rasen Bernstein’s insights offer a comprehensive understanding of the chip industry’s current landscape, highlighting the opportunities and challenges facing key players like Nvidia and Intel. As the semiconductor sector continues to evolve, navigating geopolitical tensions and technological advancements will be paramount for sustained growth and innovation.